Chronic pain can adversely affect mortgage and loan applications due to various financial challenges. Key impacts include:

- Increased medical costs, averaging $261 billion to $300 billion annually.

- Employment instability; around 24.3% of U.S. adults reported chronic pain in 2023, with significant work limitations.

- Complicated documentation requirements may lead to delays in the mortgage process.

These factors can reduce creditworthiness, complicate income verification, and increase financial strain. Understanding these dynamics can provide further insights into the application process.

Key Takeaways

- Chronic pain can complicate mortgage applications due to the need for additional medical documentation and extended timelines.

- Applicants with chronic pain may face challenges in income verification, impacting their eligibility for loans and mortgages.

- High healthcare costs associated with chronic pain can lead to increased debt levels, affecting creditworthiness and loan approval.

- Persistent financial stress from chronic pain can exacerbate existing debts, creating a cycle that complicates financial stability.

- Lenders are increasingly considering healthcare expenses in their risk assessments, which can influence borrowing capacity and approval outcomes.

The Financial Impact of Chronic Pain

Chronic pain imposes a significant financial burden on individuals and the economy. The annual medical costs associated with chronic conditions in the U.S. range between $560 billion and $635 billion. Direct healthcare expenses alone account for $261 billion to $300 billion yearly.

- Many patients require complex multimodal treatment plans, increasing overall costs.

- Individuals often face higher out-of-pocket expenses, leading to financial stress that drains personal savings.

- Disability claims related to chronic pain further strain public resources, affecting household financial stability.

- Social disparities exacerbate these challenges, resulting in unequal access to pain management and higher medical expenditures.

These factors collectively contribute to a profound impact on personal finances and economic participation.

Employment Challenges and Income Limitations

A significant portion of the workforce faces employment challenges and income limitations due to persistent pain conditions. Approximately 24.3% of U.S. adults reported chronic pain in 2023, with 8.5% experiencing significant work limitations.

- Employment instability is common, as 33% of individuals with severe chronic pain are not working 18 months post-injury.

- Chronic pain leads to an average productivity loss of 2.4 hours weekly, with some experiencing reductions of up to 9.8 hours.

- Income fluctuation is evident, with chronic pain sufferers facing about 47.7% higher lost-earnings costs than their pain-free counterparts.

These factors complicate employment records and hinder stable income verification, impacting financial stability for loans and mortgage applications.

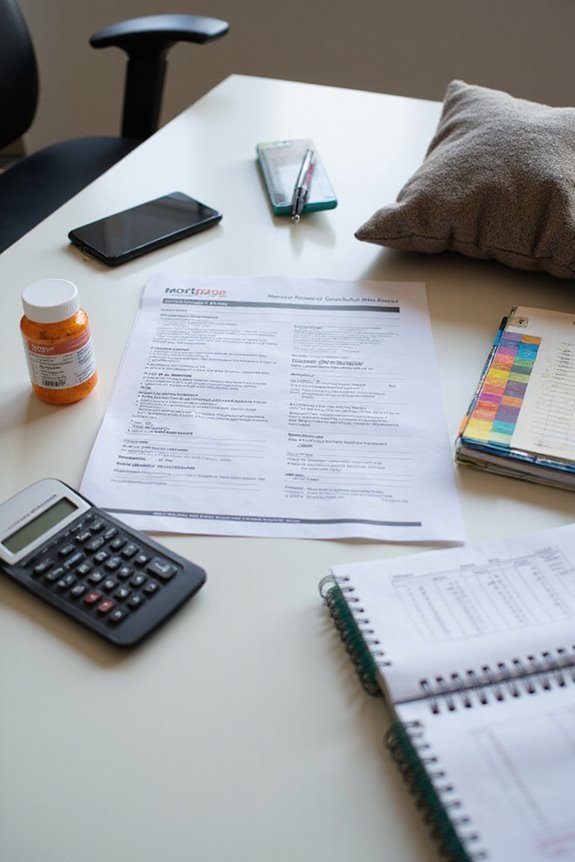

Navigating the Mortgage Application Process

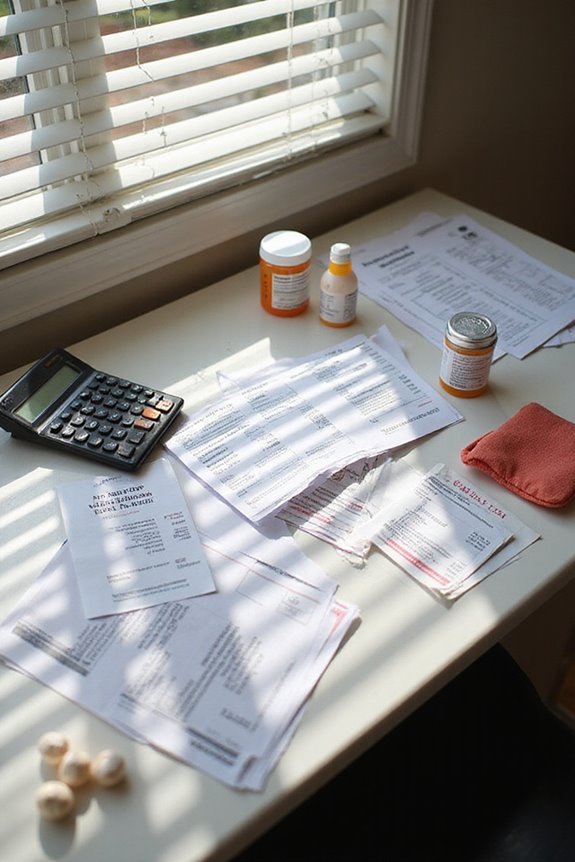

Maneuvering the mortgage application process presents unique challenges for individuals with persistent pain conditions. The extensive documentation required for income, assets, and debts can be particularly burdensome.

- Document Preparation: Chronic pain applicants may need additional medical documentation, complicating submission.

- Application Timeline: The process could extend due to health-related requirements, such as medical questionnaires or reports, which insurers may request for mortgage protection coverage.

Delays in obtaining mortgage protection insurance can further hinder the application timeline, causing stress and urgency.

– Stress Factors: The complexity of coordinating necessary documents can exacerbate the already high stress associated with the mortgage process.

Ultimately, these factors may influence lender confidence and the overall approval outcome.

Debt Levels and Their Relation to Chronic Pain

Understanding the interplay between debt levels and chronic pain is crucial for recognizing the financial challenges faced by affected individuals.

- Approximately 20% of US adults report chronic pain, with financial stress markedly linked to its severity.

- High unsecured debt, often with elevated interest rates, exacerbates financial burdens for those with chronic pain.

- Pain perception can worsen under financial strain, creating a feedback loop that intensifies both pain and debt.

- Medical treatment costs contribute to increased borrowing, leading to greater reliance on credit.

- Chronic pain episodes frequently result in lost income, further complicating debt management.

This cyclical relationship emphasizes the need for effective financial strategies to mitigate the impact of chronic pain on overall financial health.

Healthcare Costs and Their Effect on Loans

Healthcare costs greatly impact loan applications and financial stability for many individuals.

- High healthcare expenses can lead to increased loan defaults, causing lenders to reassess creditworthiness beyond traditional scoring metrics.

- Approximately 41% of American adults carry medical debt, with 12% facing bills exceeding $10,000, substantially affecting financial standing.

- Medical debt has historically reduced credit scores and negatively impacted debt-to-income ratios, complicating loan approvals.

- Recent changes in credit reporting aim to lessen medical debt’s negative influence on mortgage eligibility.

- Lenders now incorporate healthcare expenses in risk assessments, acknowledging their critical role in evaluating borrowers’ repayment capacity.

Ultimately, these factors underscore the growing recognition of healthcare costs as a substantial determinant in loan underwriting decisions.

The Borrower Experience: Pain Points in Mortgage Applications

Maneuvering through the mortgage application process frequently presents challenges for borrowers, particularly those living with chronic pain.

Document Complexity

- Extensive documentation is often required, complicating the application for those managing multiple financial obligations.

- Chronic pain sufferers may hold numerous medical loans and insurance accounts, increasing document sorting time.

Emotional Strain

- The process is perceived as stressful, particularly for individuals already managing health challenges.

- Lengthy timelines, often exceeding 30 days, add to the emotional toll.

Income Stability Challenges

- Variable income due to chronic pain complicates verification processes, often requiring additional documentation.

- This can lead to higher interest rates or decreased approval chances, further intensifying the pressure on borrowers.

Frequently Asked Questions

Can Chronic Pain Affect My Credit Score?

Chronic pain can greatly affect an individual’s credit score, leading to increased medical debt and potential income loss. This financial strain often results in unpaid bills, ultimately contributing to negative credit impacts and diminished financial stability.

Are There Specific Loans for Individuals With Chronic Pain?

Maneuvering a labyrinth, individuals with chronic pain seek loans tailored to their struggles. While chronic pain loans and disability financing exist, options remain limited, often requiring personal advocacy and creative solutions to overcome financial hurdles.

How Can I Improve My Financial Situation With Chronic Pain?

To improve financial situations amidst chronic pain, individuals can benefit from effective financial planning and budgeting tips. Prioritizing essential expenses and exploring community resources can foster stability and alleviate the emotional and financial burdens they face.

What Resources Are Available for Financial Assistance?

In a vast forest, weary travelers discover hidden paths to financial aid through support groups. These networks offer solace and resources, guiding individuals toward relief from burdens, ensuring no one journeys alone in their quest for assistance.

Can I Apply for a Mortgage if I’m on Disability?

Individuals on disability can apply for a mortgage by providing necessary income verification of their disability benefits. Lenders assess these benefits similarly to regular income, ensuring applicants meet specific criteria for successful mortgage qualification.