To obtain insurance approval for pain management devices, individuals must understand specific coverage requirements, particularly for Medicare. Essential steps include:

- Verification of insurance policy specifics.

- Compilation of thorough medical documentation proving necessity.

- Submission of requests via preferred methods, ensuring all required documents are included.

Common devices include spinal cord stimulators and TENS units, often requiring pre-authorization. Addressing potential denials involves adhering to appeals processes and maintaining effective communication with insurance carriers. Further insights on this process are available.

Key Takeaways

- Gather comprehensive medical documentation, including pain history and previous treatment outcomes, to demonstrate medical necessity for the device.

- Verify insurance coverage requirements and pre-authorization processes specific to the pain management device you seek.

- Submit all required documents through the preferred method—online, fax, or phone—ensuring accuracy and completeness to avoid claim denials.

- Monitor the status of your request regularly and maintain communication with the insurer to address any issues promptly.

- If denied, collect detailed reasons and follow the appeals process with thorough documentation and adherence to insurer timelines.

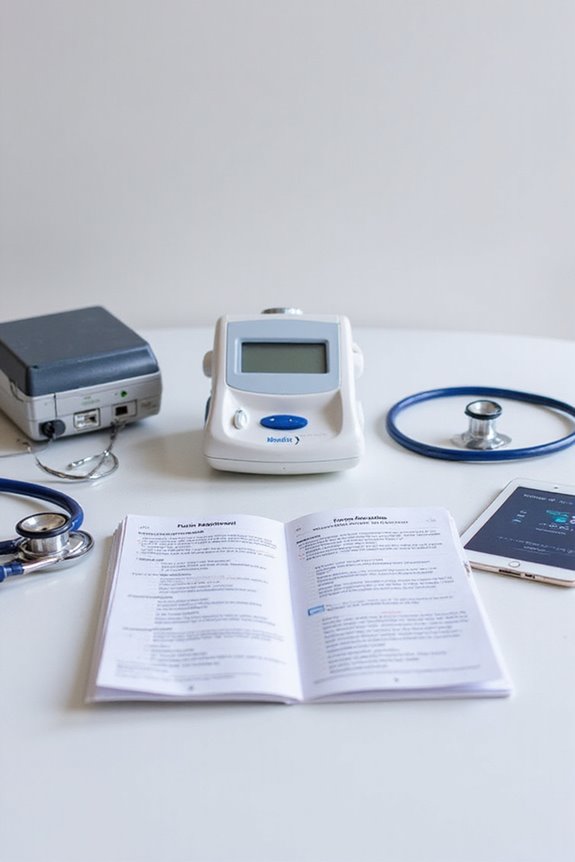

Understanding Insurance Coverage Requirements

In order to obtain insurance approval for pain management devices, it is essential to understand the specific coverage requirements set forth by insurance providers. These requirements often include:

- Commonly Covered Devices: Spinal cord stimulators, implanted infusion pumps, and nerve stimulators.

- Device Indications: Coverage is typically granted for conditions like failed back surgery syndrome and diabetic peripheral neuropathy.

- Documentation Needed: A detailed medical history, diagnosis of chronic pain, and evidence of insufficient response to conservative treatments are vital.

- Pre-Authorization Requirements: Insurance policies necessitate pre-authorization, which involves submitting medical records and physician referrals.

Understanding these coverage limits and the necessity for thorough documentation can greatly enhance the likelihood of approval for pain management devices, fostering a sense of security and belonging for patients steering through this process.

Medicare Coverage Considerations for Pain Devices

Medicare plays a essential role in providing coverage for pain management devices, particularly for individuals experiencing chronic pain. Medicare coverage includes:

- Pain Management Devices: Specific coverage for TENS units is granted primarily for acute post-operative pain relief, requiring FDA approval and adherence to manufacturer guidelines.

- Spinal Cord Stimulators (SCS): Coverage may be available for candidates with chronic intractable pain, contingent upon extensive evaluations and a trial stimulation process.

- Medical Necessity: Documentation is critical, requiring a thorough medical history and evidence of conservative treatment failure.

Importance of Medical Documentation and Patient Evaluation

Medical documentation and patient evaluation are foundational components in securing insurance approval for pain management devices. Thorough medical records are essential, detailing the patient history, pain assessment, and clinical decision-making process.

Key elements include:

- A thorough pain history, describing severity and duration.

- Evidence of previous treatments and their outcomes.

- Documentation of diagnostic tests relevant to the pain condition.

Accurate patient evaluation must cover:

- Pain location, intensity, and functional limitations.

- Objective measures to quantify pain and track progress.

Documentation must adhere to payer-specific standards, justifying medical necessity and reducing claim denials. Regular updates to patient records guarantee ongoing justification for device use and reflect changes in pain status and treatment efficacy.

Steps for Pre-Authorization and Insurance Submission

Securing pre-authorization for pain management devices necessitates a systematic approach to confirm compliance with insurer requirements.

Verification of Insurance Requirements

- Confirm pre-authorization needs through policy review.

- Consult payer-specific resources to identify requirements.

- Stay updated on changing rules.

Preparation of Documentation

- Compile clinical documentation proving medical necessity.

- Include evaluation records and justifications.

- Use insurer-specified forms to guarantee completeness.

Submission Process

- Choose the preferred submission method: online, fax, or phone.

- Attach all required documentation with signed forms.

Follow-Up

- Regularly check on the status of the request.

- Document all communications and follow-ups.

Utilizing a pre-authorization checklist and adhering to insurance claim tips can greatly enhance the likelihood of approval.

Common Insurance Policies and Types of Devices Covered

What types of insurance policies typically cover pain management devices, and what are the common devices included?

Insurance policies such as Medicare and many private plans provide coverage for pain management devices, although coverage limits and requirements vary.

Medicare Coverage:

- Covers durable medical equipment (DME) like TENS units when deemed medically necessary.

- Requires documentation and physician justification for approval.

Private Insurance Policies:

- Coverage varies widely, often requiring prior authorization for devices such as spinal cord stimulators.

- Out-of-pocket costs may include copayments and deductibles.

Common Device Types Covered:

- TENS units and spinal cord stimulators.

- Infusion pumps and implantable devices with prior authorization.

- Wearable pain relief devices, subject to insurer policies.

Understanding the specifics of device types and coverage limits is essential for successful claims.

Recommendations to Improve Approval Odds

To improve the odds of obtaining insurance approval for pain management devices, it is essential to adhere to specific recommendations that streamline the submission process.

Comprehensive Documentation

- Include a current insurance card, valid ID, and a pre-authorization letter from the treating physician.

- Submit detailed clinical documentation supporting device necessity.

Prior Authorization

- Verify patient eligibility and benefits before ordering.

- Initiate pre-authorization requests early, using group-level identifiers when required.

Demonstrating Medical Necessity****

- Provide peer-reviewed evidence of improved patient outcomes.

- Reference national coverage determinations and document treatment failures.

Coordination

- Engage insurance specialists and maintain communication with insurers.

- Use insurance verification services to minimize administrative errors.

These strategies enhance patient advocacy and optimize approval chances for necessary treatments.

The Role of Healthcare Providers in the Approval Process

Healthcare providers play a pivotal role in the approval process for pain management devices, greatly impacting patient access to necessary treatments.

Provider Responsibilities

- Verify patient insurance eligibility to minimize claim denials.

- Check coverage details, including deductibles and co-pays, pertinent to pain management devices.

Insurance Verification

- Accurate verification can prevent prior authorization denials, which often stem from incomplete information.

- Providers must guarantee correct coding for demographics, procedures, and diagnoses to avoid errors.

Documentation and Submission

- Initiate prior authorization by submitting clinical notes, treatment history, and necessary diagnostic information.

- Follow insurer guidelines rigorously to establish medical necessity, demonstrating the need for device approval.

Effective management of these responsibilities is vital for timely patient access to essential pain management resources.

Addressing Common Challenges and Denials

Addressing common challenges and denials in the approval process for pain management devices is critical to ensuring patient access to necessary treatments.

Prior Authorization Issues

Many insurers require prior authorization, leading to delays of weeks or months. Incomplete submissions often result in denials, emphasizing the coding accuracy importance.

Documentation Errors

Incorrect patient demographics and outdated codes frequently cause claim rejections. Missing documentation that supports medical necessity can also hinder approval.

Coverage Variability

Insurance plans vary greatly, affecting eligibility and benefits. Certain devices may be classified as experimental, limiting coverage options.

Regulatory Concerns

Insurers scrutinize claims for compliance with FDA regulations and clinical trial data.

Implementing effective claims management strategies and ensuring thorough documentation can greatly enhance approval rates for pain management devices.

Importance of Follow-Up With Insurance Carriers

Securing timely follow-up with insurance carriers is essential for optimizing claims management and enhancing revenue cycle efficiency. Effective follow-up strategies include:

- Systematic tracking of accounts receivable to prioritize claims needing attention.

- Automated systems that streamline follow-ups, reducing manual errors and missed deadlines.

Delays in follow-up can extend reimbursement cycles, negatively impacting cash flow. Utilizing multi-channel communication techniques, such as phone, email, and online portals, increases the likelihood of prompt resolutions. Clear documentation submitted to insurers supports faster claim adjudication and helps maintain accountability. Regular contact with insurance representatives secures outstanding requirements are clarified, reducing the risk of claims falling through administrative gaps. Ultimately, consistent follow-up enhances liquidity by decreasing days in accounts receivable and increasing net reimbursements.

Navigating the Appeals Process for Denied Claims

Steering through the appeals process for denied insurance claims requires a strategic approach to guarantee successful outcomes.

Appeal Levels

- First-level: Request reconsideration, often supported by peer-to-peer communication with a medical reviewer.

- Second-level: A medical director reviews the case to assess adherence to coverage guidelines.

- External review: An independent third-party physician evaluates the claim.

Documentation

- Detailed denial reasons from the insurer are essential.

- Submit thorough medical documentation and verify billing codes.

Timelines

- File appeals promptly, typically within 60 days of denial.

- Follow insurer-specific submission procedures.

Communication

- Maintain clear, factual correspondence with insurers.

- Document all interactions for potential escalation.

Advocacy Options

– Utilize external advocacy options if internal appeals fail, including legal counsel or state agencies.

Frequently Asked Questions

How Long Does the Insurance Approval Process Usually Take?

The insurance approval process typically varies, influenced by insurance timelines and approval factors. Standard requests may take 1 to 3 days, while complex cases can extend beyond a week, creating uncertainty for many individuals traversing healthcare.

Can I Appeal a Denial on My Own?

Individuals can indeed appeal a denial on their own. Understanding the appeal process and carefully addressing denial reasons strengthens their case, fostering a sense of empowerment and belonging in managing complex insurance challenges.

What Happens if My Device Is Not Covered?

When a device is not covered, patients may feel lost, exploring device alternatives and steering through complex coverage options. This journey often leads to financial strain and delayed treatment, underscoring the importance of equitable healthcare access for all.

Are There Alternative Funding Options for Uninsured Patients?

Uninsured patients can explore alternative funding options, such as crowdfunding options and medical grants, to alleviate financial burdens. These resources foster community support, enabling individuals to access necessary treatments and promoting a sense of belonging among participants.

How Can I Find a Pain Specialist Familiar With Insurance Requirements?

To find a pain specialist familiar with insurance requirements, individuals should seek providers who understand pain management and insurance policies, utilize insurer directories, and rely on recommendations from primary care physicians to guarantee effective treatment coverage.