Planning for unexpected pain treatment expenses involves several strategic steps. First, understanding the financial impact is vital; costs can reach up to $635 billion annually in the U.S. Establishing an emergency health fund of three to six months’ living expenses can provide a necessary buffer. Optimizing health insurance coverage reduces out-of-pocket expenses. Utilizing HSAs and FSAs can aid in managing costs effectively. Exploring Medicare and Medicaid options guarantees access to necessary treatments. More insights on these strategies follow.

Key Takeaways

- Establish an emergency health fund with three to six months of living expenses to cover unexpected medical costs.

- Optimize health insurance coverage by reviewing plans for pain management treatment specifics and preventive care benefits.

- Utilize Health Savings Accounts (HSAs) for tax-advantaged savings to cover unforeseen medical expenses, with funds rolling over annually.

- Explore Flexible Spending Accounts (FSAs) for immediate tax savings on out-of-pocket costs related to pain treatment, planning contributions wisely.

- Evaluate Medicare and Medicaid options for coverage of pain treatments and medications, understanding cost-sharing responsibilities for effective management.

Understanding the Financial Impact of Pain Treatment

Understanding the financial impact of pain treatment is essential for both individuals and healthcare systems, as pain-related issues represent a significant economic burden.

- Annual incremental healthcare costs due to pain in the U.S. range from $261 billion to $300 billion.

- Total costs, including medical treatment, disability payments, and lost productivity, sum up to $635 billion annually.

- Individuals with severe pain spend about $7,726 more on healthcare each year, emphasizing the need for effective pain management strategies. Additionally, investing in heating pads for pain relief can be a cost-effective method to manage chronic discomfort at home.

Budgeting for treatments becomes critical, particularly for the 50 million Americans affected by chronic pain. With 74% of high-impact chronic pain sufferers unemployed, financial planning for ongoing treatment is crucial to alleviate the compounded economic strain on both individuals and the healthcare system.

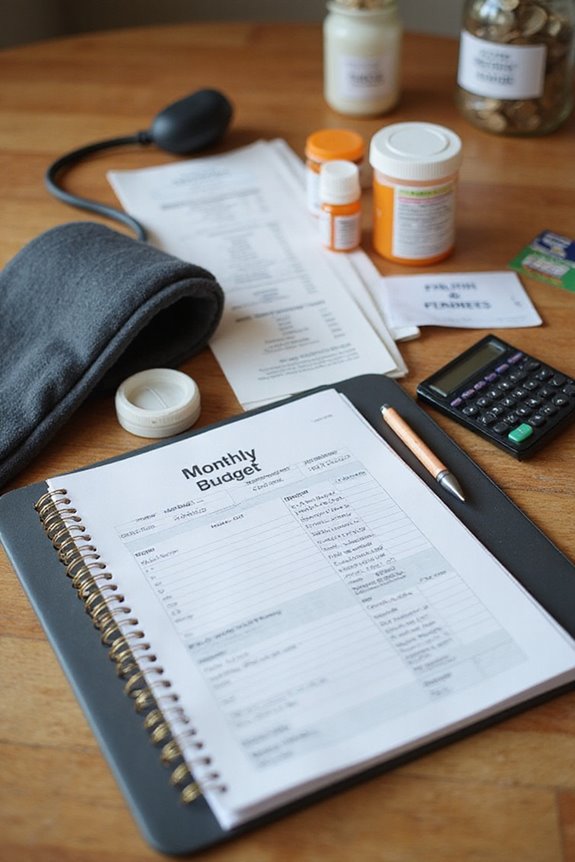

The Importance of an Emergency Health Fund

An emergency health fund serves as an essential financial buffer against unforeseen medical expenses, particularly for individuals facing pain treatment requirements.

Emergency Fund Benefits

- It reduces reliance on credit cards or high-interest loans, mitigating financial strain.

- Having dedicated savings helps avoid delaying necessary care due to cost concerns, which can worsen health outcomes.

- It supports those underinsured, with nearly 25% of insured U.S. adults facing high out-of-pocket costs.

Establishing a fund of three to six months of living expenses can foster financial peace, reducing healthcare-related anxiety. As out-of-pocket costs continue to rise—totaling $505.7 billion in 2023—maintaining an emergency health fund is increasingly crucial for steering through unexpected pain treatment expenses effectively. Additionally, using a heating pad can provide effective pain relief for various types of discomfort, helping to minimize the need for costly treatments.

Optimizing Your Health Insurance Coverage

Enhancing health insurance coverage is critical for managing unexpected pain treatment expenses effectively. Individuals should evaluate various health insurance plans, including HMOs and PPOs, to identify the best fit for their health needs and financial situations.

- Understand network provider options to minimize co-pays and out-of-pocket costs.

- Implement deductible management strategies by selecting a plan that balances affordable monthly premiums with manageable deductibles.

Review coverage specifics for pain management treatments, including physical therapy and specialist visits, to guarantee thorough support.

Maximizing benefits from preventive care and wellness programs can further mitigate costs. Regularly review and adjust plans during open enrollment to stay aligned with evolving health needs, guaranteeing ideal financial protection against unexpected medical expenses.

Exploring Medicare and Medicaid Options

How does one navigate the complexities of Medicare and Medicaid when seeking pain treatment options? Understanding Medicare benefits and Medicaid options is vital for accessing pain management services.

Medicare Benefits:

- Covers physical therapy, occupational therapy, acupuncture (limited to chronic lower back pain), and chiropractic services (for spinal subluxation).

- Prescription medications for pain are available under Part D, with prior authorization often required.

Medicaid Options:

- Coverage for pain medications varies by state; typically includes opioids and non-opioid alternatives.

- Access to integrative pain treatments is dependent on state-specific policies, which may impose prescription limits and prior authorization.

Both programs emphasize non-invasive therapies and require beneficiaries to evaluate cost-sharing responsibilities. Understanding these factors is essential for effective pain management.

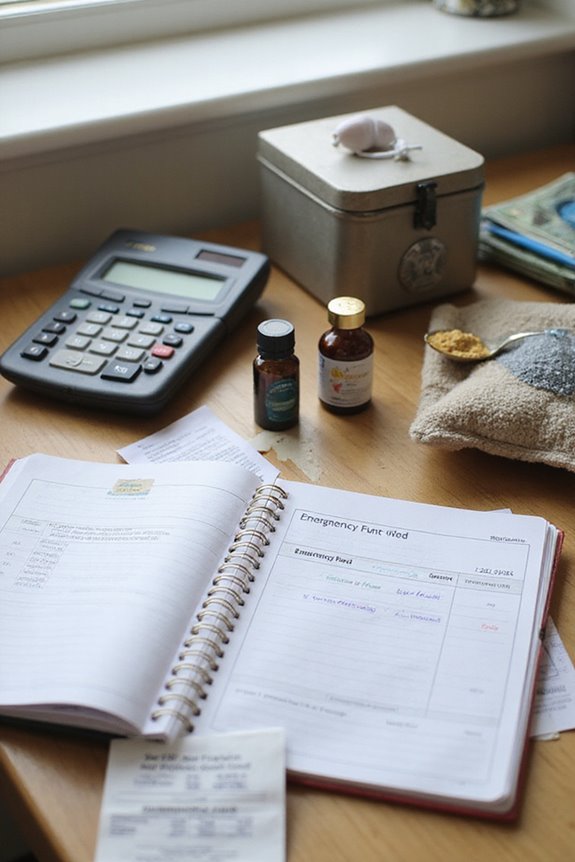

Utilizing Health Savings Accounts and Flexible Spending Accounts

Utilizing Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) presents a strategic approach to managing unexpected pain treatment expenses, particularly when individuals are faced with rising healthcare costs.

HSA Eligibility and Contributions

- HSAs allow yearly contributions up to IRS limits, building a reserve for unforeseen medical costs.

- Funds roll over annually, offering long-term financial flexibility.

FSA Limits and Immediate Benefits

- FSAs are funded via salary deferrals, providing immediate tax savings but necessitating careful planning due to the use-it-or-lose-it policy.

- Reimbursable expenses include prescription pain medications, diagnostic tests, and certain alternative therapies, contingent on appropriate documentation.

Understanding HSA eligibility and FSA limits empowers individuals to effectively manage out-of-pocket costs associated with pain treatment.

Seeking Financial Counseling and Assistance Programs

Financial counseling and assistance programs play a critical role in alleviating the burden of unexpected medical expenses, particularly for individuals facing pain treatment. These programs enhance financial literacy, enabling patients to understand treatment costs and available payment options.

Key functions of financial counselors include:

- Reviewing treatment plans and clarifying medical bills.

- Assisting with insurance navigation and eligibility for Medicaid or Medicare.

- Connecting patients with financial assistance outreach programs.

Studies indicate that patients who engage with financial counseling save an average of $33,265 annually on medications. Additionally, regular contact with financial navigators reduces anxiety related to medical costs. Increasing awareness of financial aid options correlates with higher program utilization and decreased financial hardship, fostering a supportive environment for recovery.

Preparing for Future Healthcare Cost Increases

As healthcare costs continue to rise, individuals must proactively anticipate and plan for future expenses associated with medical treatment. Cost projections indicate that healthcare inflation will markedly impact personal finances.

- U.S. healthcare spending rose by 7.5% in 2023, reaching $4.9 trillion.

- The projected medical cost trend is 8% for the Group market and 7.5% for the Individual market in 2025.

- Global medical costs are expected to increase at an average rate of 10.4% in 2025, with North America at 8.7%.

Patients should consider budgeting for these increases, particularly in prescription drug spending and chronic condition management. Evaluating potential out-of-pocket expenses can provide a clearer financial picture, ensuring preparedness for future healthcare needs.

Frequently Asked Questions

What Types of Pain Treatments Are Typically Covered by Insurance?

Insurance coverage for chronic pain treatments varies considerably, with commercial plans typically covering a wider range of therapies, including alternative therapies like physical and occupational therapy, while Medicaid focuses primarily on medication options.

How Can I Negotiate Medical Bills Related to Pain Treatment?

To negotiate medical bills effectively, individuals should employ bill negotiation strategies, utilize effective communication tips, prepare documentation, research costs, and maintain polite persistence, ensuring a collaborative approach in discussions with healthcare providers for ideal outcomes.

Are There Discounts Available for Cash Payments on Treatments?

Cash payment discounts are often available for treatments, allowing patients to negotiate lower costs. Hospitals may offer significant savings, especially in areas with high uninsurance rates, encouraging self-pay patients to seek affordable healthcare options.

Can I Claim Pain Management Expenses on My Taxes?

Claiming pain management expenses on taxes is possible, as long as they qualify as medical expenses. Tax deductions apply only to unreimbursed costs exceeding 7.5% of adjusted gross income, encouraging careful documentation and planning.

How Do I Find Patient Assistance Programs for Specific Medications?

To find patient assistance programs for specific medications, individuals can explore various patient resources, including manufacturer websites, directories from healthcare organizations, and advocacy groups, which provide essential information on medication assistance and eligibility criteria.